when is gst payable on sale of property in malaysia

If sold after 6 years. From 1 Jan 2019 if you are making a local sale of prescribed goods ie.

Free Real Estate Agent Commission Invoice Template Word Pdf Eforms

Whether buying selling or leasing you will be classified as an enterprise and.

. Stamp duty is one of the unavoidable costs in property purchase in Malaysia. If sold before 5 years. GST will supplant the Sales Tax come April 2015.

Effective 1 April 2015 any supply of rights to use IP made in Malaysia by a GST registered person will be subject to GST of 6. GST and property GST and property Goods and services tax GST applies to the supply of certain property types if the supplier seller or vendor is registered or required to be registered for GST. GST is charged on all taxable supplies of goods and services in Malaysia except those specifically exempted.

GST is also chargeable on the supply of movable furniture and fittings in both residential and non-residential properties. A zero rate of GST may. Sale of residential property is GST exempt.

You must register for GST if your annual turnover in the previous 12 months was more than 60000 or is likely to be in the next 12 months. In most cases yes you will be required to pay GST on a commercial property purchase. About residential property A.

Sale of commercial properties will be subject to 6. If sold within 3 years. Under the Stamp Act stamp duty is tax payable on the written documents during the sale andor transfer of a.

Turnover is the total value of supplies made. Real estate agents must c A Singapore Government Agency. Now it is quite clear that sale of land will not attract GST and sale of building after obtaining completion certificate or after its first occupation will not attract GST.

However developers will pay GST on some of their production inputs. Import GST payable RM6050000 x 6RM 363000 GST in Malaysia on imported goods needs to be declared in a specific customs declaration form and the tax must be paid at the point of. Mobile phones memory cards off-the-shelf software to a GST-registered customer you need to apply customer.

RPGT increases progressively as follows for commercial property. It is important to understand that not all types of property is. Tax Scheme on Residential Property The Similarities In comparing both tax schemes we have to first identify their.

If sold before 4 years. GST only applies to the sale of certain property types if the seller vendor is registered or required to be registered for goods and services GST purposes.

How Gst Will Impact Home Prices The Property Market

Are You Gst Registered What You Need To Know About Gst

Update On Gst And Commercial Property In Malaysia Taxation News

How To Charge Sales Tax In The Us A Simple Guide For 2022

Malaysia Property Real Estate Law 2018 Rpgt Gst My Lawyer

Finance Malaysia Blogspot Gst How It Affects Our Life Insurance Policy March 2015

Australia Sales Tax Rate Gst 2022 Data 2023 Forecast 2006 2021 Historical

How Gst Will Impact Home Prices The Property Market

What S The Difference Between A Vat Gst And A Sales Tax Quora

Update On Gst And Commercial Property In Malaysia Taxation News

How Will Gst Impact Malaysia S Property Market

Property Developers Transitioning From Gst To Sst Accountants Today Malaysian Institute Of Accountants Mia

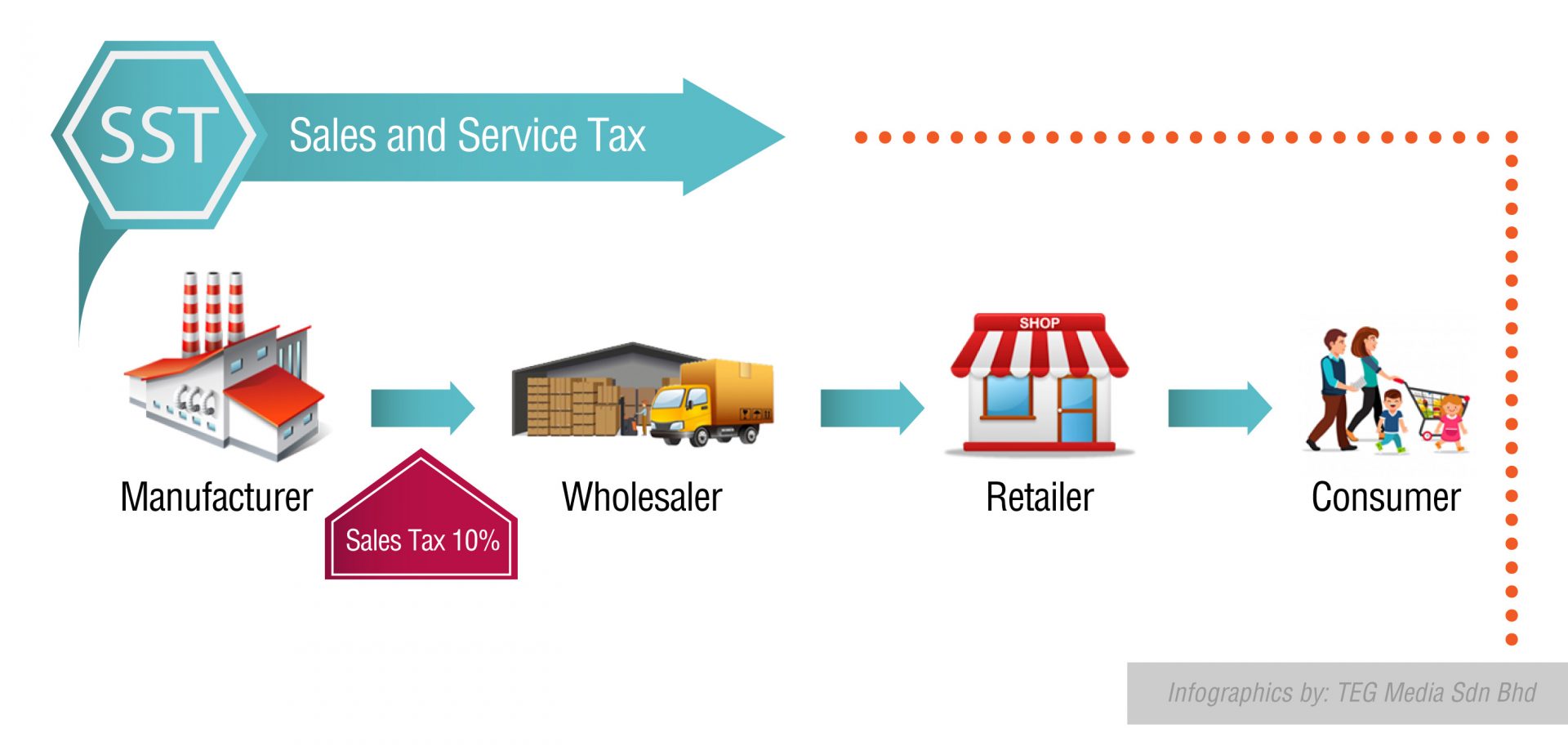

Sst Vs Gst How Do They Work Expatgo

Update On Gst And Commercial Property In Malaysia Taxation News

Pdf The Effects Of Gst Goods And Services Tax On Construction Capital Costs And Housing Property Prices Christine Teoh Academia Edu

Impact Of Gst On Real Estate Sector

Indirect Tax Gst Chat All You Need To Know In This Issue Issue Pdf Free Download

0 Response to "when is gst payable on sale of property in malaysia"

Post a Comment